OVERVIEW OF E-INVOICING FOR BUSINESS DIGITALISATION

Watch our video series to learn about Malaysia's National E-Invoicing Initiative highlighting its benefits to businesses, the roles of MDEC and LHDNM, how Peppol network enables global interoperability, and how to choose the right implementation model for your business.

OBJECTIVE

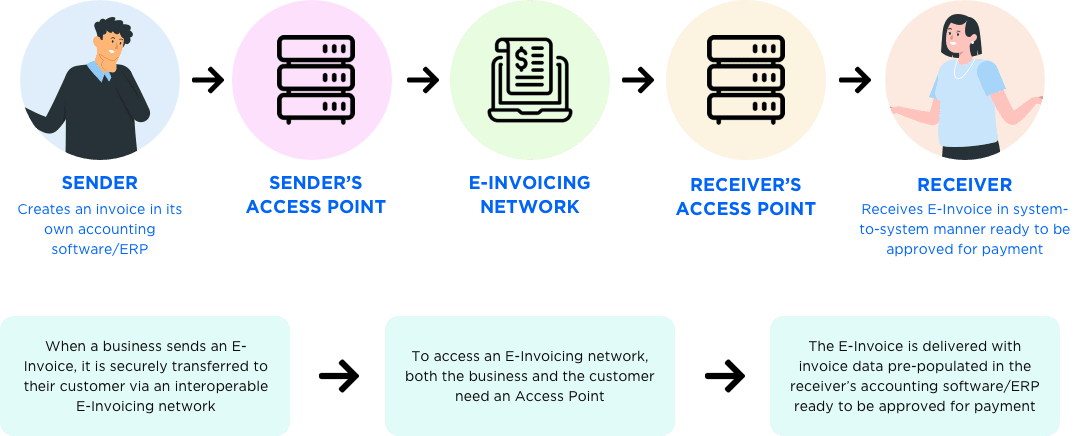

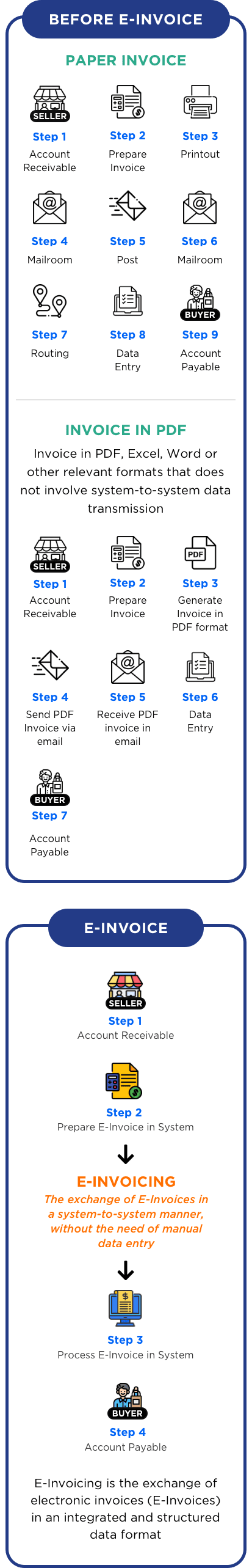

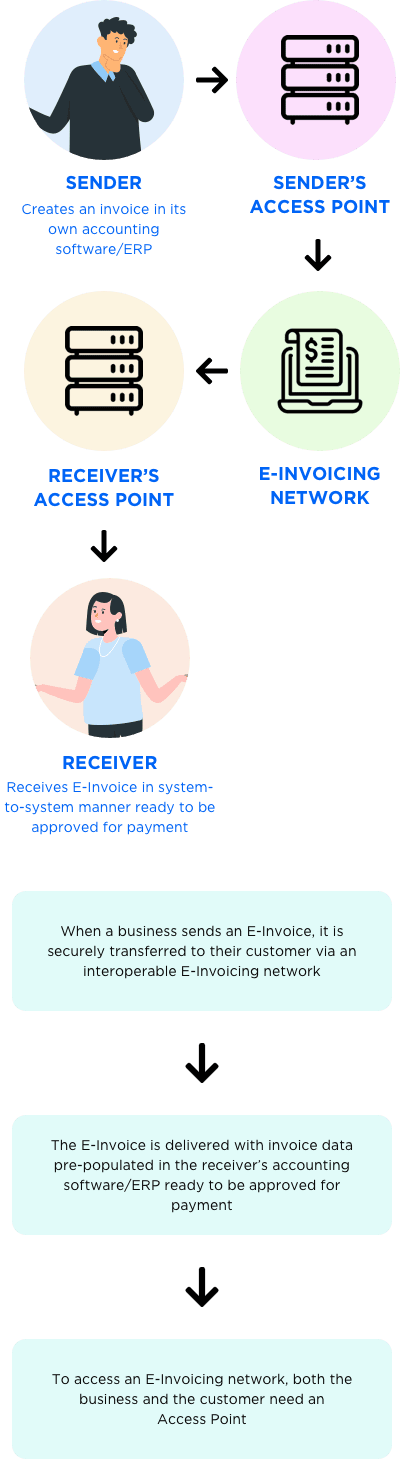

The National E-Invoicing Initiative aims to drive interoperable E-Invoicing by digitalising how businesses send invoices to other businesses, allowing different accounting software and Enterprise Resource Planning (ERP) systems to send and receive e-invoices in a system-to-system manner.

The Benefits

INCREASE BUSINESS

EFFICIENCY

Manual data entry and physical paper handling processes can be eliminated through the implementation of E-Invoicing. As a result, businesses can transact invoices more efficiently and seamlessly, with accurate traceability.

IMPROVE

CASHFLOW

With E-Invoicing, billing and calculation errors can be reduced significantly, thus accelerating payments and minimise disputes in irregularities.

EFFICIENT TAX

COMPLIANCE

The implementation of a compliant interoperable E-Invoicing framework will ensure an organised work process and facilitate effective tax reporting.

Malaysia’s Peppol Solution and Service Providers:

Freemium and Affordable E-Invoicing Solutions for SMEs

Empowering SMEs with Affordable Peppol and LHDNM-Compliant E-Invoicing Solutions

Peppol Service Providers (SP)

Peppol Service Providers (or Access Point (AP) Providers) are responsible for creating and maintaining the gateways that connect businesses and software to the E-Invoicing network.

Learn about the requirements to become a Peppol SP in Malaysia.

Peppol-Ready Solution Providers (PRSP)

Peppol-Ready Solution Providers are accounting software, ERP or solutions that provide the functionality of sending and receiving e-Invoice without necessarily becoming an Access Point (AP).

Learn about the requirements to become a PRSP in Malaysia.

Malaysia PINT Specifications

Peppol International Invoice (PINT) is the specification that facilitates interoperable exchange of invoices across the Peppol Network at a global level.

Learn more information on Malaysia PINT specifications.

Events Happening

This event offers valuable e-invoicing solutions from the accredited Peppol Service Providers (SP) in an exhibition set up and networking opportunities. Prepare your business for the upcoming mandatory tax compliance effective 1 August 2024. Don’t miss this opportunity to enhance your knowledge and connect with experts in the field.